Introduction

Picture colonial markets buzzing with trade, where the history of the U.S. dollar first sparked to life. Adopted in 1785, this currency grew from a bold idea to a global powerhouse, marked by its iconic “$” symbol. It weaves a tale of America’s economic rise, from silver coins to modern paper notes. Let’s dive in and see how this currency shaped history. Its journey is one of ambition and change.

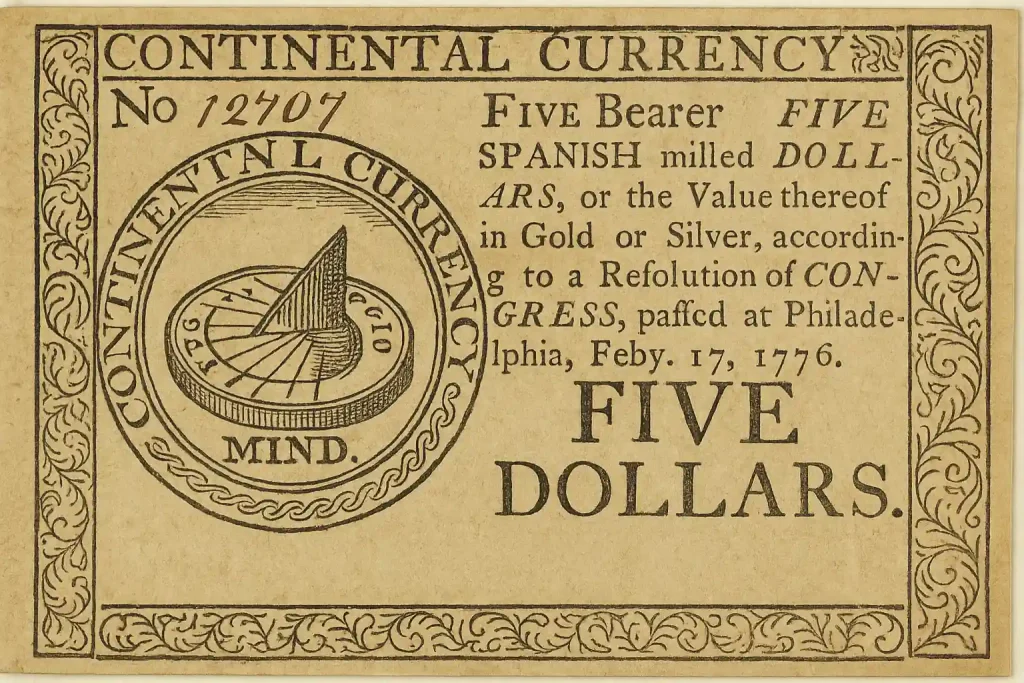

Before 1776, colonists juggled British pounds and Spanish silver dollars. However, independence demanded a currency of their own, inspired by those Spanish coins. Consequently, the history of the U.S. dollar became a story of unity and grit. Yet, it faced challenges, like disputes over value and trust. This tale shows how one currency left a lasting mark.

A New Nation’s Money

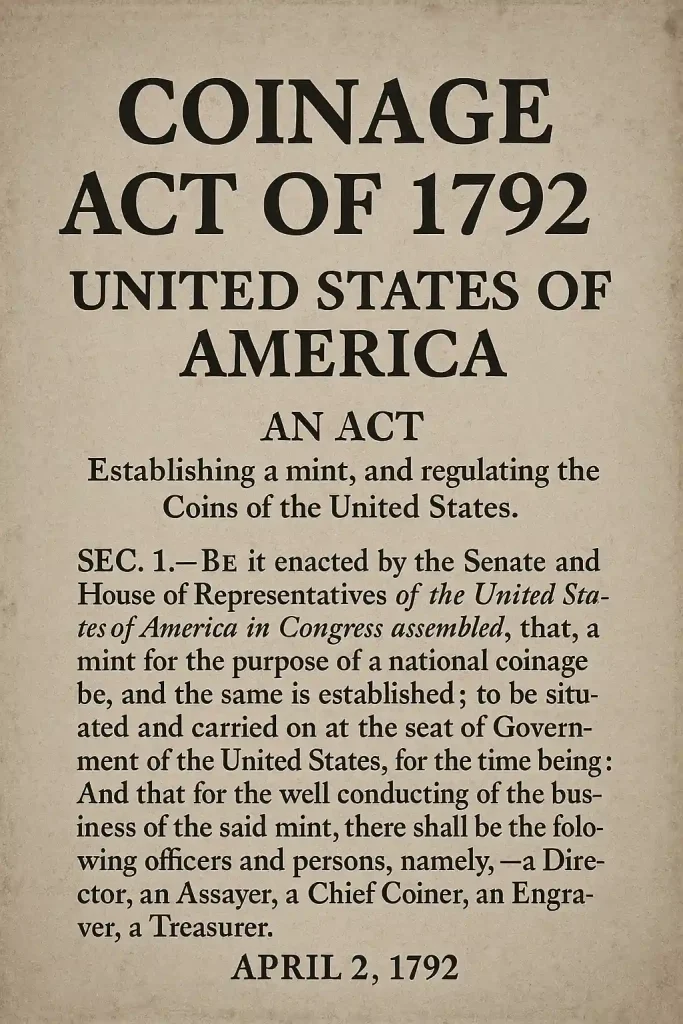

In colonial days, Spanish silver dollars, or “pieces of eight,” were the coins everyone trusted. British pounds led before 1776, but Spanish coins ruled trade. Therefore, in 1785, the Continental Congress picked “dollar” as America’s currency, drawing from those coins. The Coinage Act of 1792 made it official, pegging the dollar to 371.25 grains of silver. As a result, the dollar’s origins tied America’s money to a familiar standard.

The U.S. Mint opened in Philadelphia in 1792, crafting silver and gold coins. Yet, these dollars were scarce, so Spanish coins lingered until 1857. Meanwhile, the history of the U.S. dollar faced hiccups with its silver-and-gold backing, as metal prices swung. This caused shortages and confusion. The early days were about proving a new nation’s currency could stand firm.

By the 1800s, the dollar gained traction as America expanded. However, private banks issued their own paper notes, creating a jumble of values. During the Civil War in 1861, the government launched “greenbacks,” federal paper dollars with a green hue. This blended coins and paper, setting the stage for a unified currency system that carried the nation forward.

A Standard for Value

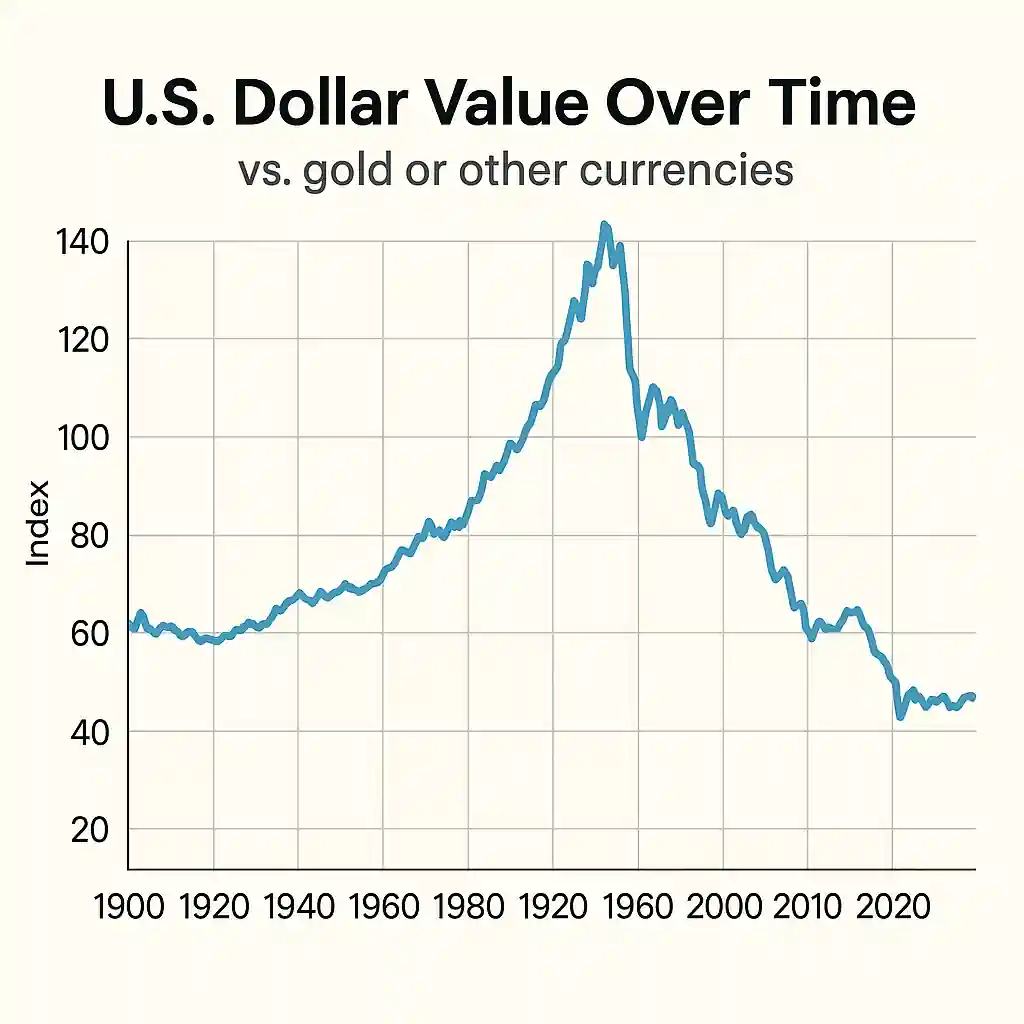

The history of the U.S. dollar grappled with keeping its value steady. From 1792 to 1900, it leaned on silver and gold, but shifting prices caused chaos. As a result, debates flared over which metal should lead. In 1900, the Gold Standard Act tied the dollar to gold at $20.67 per ounce, locking in the gold standard. This brought stability, making the dollar a trusted trade partner.

Fast-forward to 1913, when the Federal Reserve stepped in. It rolled out Federal Reserve Notes, the paper dollars we use today, backed by gold and government faith. Furthermore, these notes replaced messy bank-issued money, creating consistency. The Federal Reserve also adjusted the money supply to stabilize the economy. Thus, the dollar’s worth began to rely on policy, not just metal.

The Great Depression in the 1930s shook the gold standard. In 1934, therefore, the U.S. reset gold to $35 per ounce, limiting its daily use. While Americans couldn’t swap dollars for gold, the dollar held strong overseas. This shift to a government-backed system was a bold move, paving the way for the dollar’s global rise.

Rise to Global Power

Here’s the twist: after World War II, the history of the U.S. dollar soared to new heights. In 1944, the Bretton Woods Agreement named it the world’s reserve currency, tied to gold at $35 per ounce. Consequently, other nations pegged their currencies to the dollar, cementing its global currency status. This gave America a financial edge, as countries stockpiled dollars for trade. The dollar’s colonial roots were now a distant memory.

By the 1960s, U.S. spending on wars and programs drained gold reserves. For instance, countries like France traded dollars for gold, exposing cracks. In 1971, therefore, President Nixon ended the gold link, a move called the “Nixon Shock.” The dollar became a currency backed by trust in America, not metal. Despite fears, its global currency role stayed strong, thanks to America’s economic might.

This global power brought advantages. America could borrow cheaply, as nations held dollars for commerce. Moreover, the “$” symbol, born from Spanish “ps” for peso, became a worldwide emblem. Federal Reserve Notes, packed with anti-fake features, spread globally. Yet, this dominance sparked debates about one nation’s currency ruling the world.

Adapting to a Modern World

In recent decades, the history of the U.S. dollar has shown its knack for keeping up. After 1971, its value floated against other currencies, shaped by market forces. Consequently, the Federal Reserve tweaked interest rates to tame inflation, ensuring stability. In the 1980s, paper dollars added vibrant designs and microprinting to stop counterfeiters. The dollar evolved to fit a fast-moving world.

Global trade leaned heavily on the dollar. Although digital payments and credit cards cut cash use, the dollar remained key for oil deals and major transactions. Additionally, its strength let America run trade deficits, as other countries held dollars. However, this raised concerns about relying too much on one currency, with the euro gaining ground as a rival.

Technology is now shaping the dollar’s future. Cryptocurrencies are booming, so the Federal Reserve is exploring a digital dollar. Meanwhile, the “$” symbol stays iconic, but its role might shift in a cashless era. The history of the U.S. dollar keeps evolving, proving its ability to adapt amid new challenges on the global stage.

Debates and Questions About the Dollar

The dollar’s global grip stirs big questions. Is it fair for one country’s currency to dominate? Its reserve status lets America borrow easily, but critics say it strains other economies. Social media buzz, for example, credits the Bretton Woods system to America’s post-war savvy, not mere chance. These debates keep the dollar’s role in the spotlight.

Could the euro or yuan take over? The dollar’s strength rests on America’s economy, military, and trusted systems. In 2023, it led currency rankings, but digital coins like Tether are shaking things up. Moreover, stablecoins add new competition. The dollar’s future hinges on whether global trust remains steady in a changing world.

What’s next for the dollar? With cryptocurrencies on the rise, the Federal Reserve is studying a digital version. The “$” symbol, tied to Spanish coins, still shines, but its form may evolve. Thus, the dollar’s path, from silver to digital dreams, keeps economists guessing. It remains a powerhouse, but the world is watching its next steps.

Leave a Reply