Introduction

Imagine a world where a piece of paper or a digital number holds sway over your life. The illusion of money lies in its ability to seem valuable, despite being a shared belief with no real substance. Unlike food or water, money meets no basic need, yet we trade it for goods, status, and dreams. This faith-based value system thrives because we all agree to treat it as real. Let’s explore why money is humanity’s greatest myth and how it shapes our world.

Money’s worth depends on a fragile pact we call collective trust, without which it’s just paper or digits. This non-intrinsic value of currency reveals its true nature as a social construct, not a tangible asset. From ancient coins to digital tokens, its story is about belief, not fact. This article dives into the roots, impacts, and risks of this belief-driven value, uncovering the truth behind what we value most.

The Roots of Money

Centuries ago, people bartered goods like grain for tools, but this system was flawed. If you had wheat but needed shoes, you had to find someone with shoes who wanted wheat. To solve this, early societies used shells or metals as money, valued for their rarity or beauty. These became symbols of worth, planting the seeds for the illusion of money. Their value rested on collective trust, not practical use.

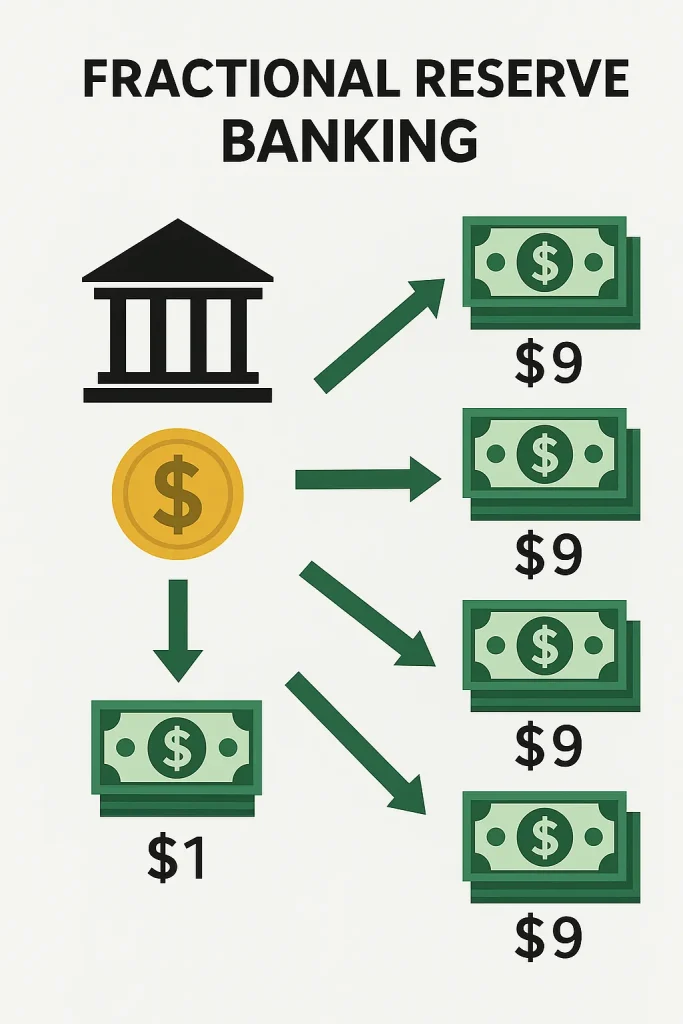

As societies expanded, metal coins and later paper notes replaced these items. Unlike gold, paper had no intrinsic value of money, relying entirely on shared faith in its worth. For instance, governments issued notes backed by promises, not goods. Meanwhile, banks stored wealth as numbers, making money more abstract. This shift turned money into a cornerstone of the economic system, driven by belief.

By the 20th century, “fiat” money, backed by government decree, became the norm, cutting ties to gold. This deepened the monetary myth, as value now hinged solely on trust in institutions. However, it enabled global trade and growth, showing the power of a shared belief. Money’s roots reveal how a fix for barter grew into a complex, faith-based economic system.

Why Is Money an Illusion?

At its core, money is a myth because it lacks real worth on its own. A dollar bill or bank balance is useless without society’s agreement to accept it. For example, in crises where faith collapses, cash can become worthless overnight. The illusion of money persists because we uphold collective trust, believing it will buy goods tomorrow. This trust is the fragile thread holding the system together.

Unlike a chair or bread, money’s value isn’t tied to its use. It’s a promise, backed by governments or shared belief, but promises can break. Historical hyperinflations, where money lost meaning, show this risk. Furthermore, the non-intrinsic value of currency means its power comes from our willingness to treat it as real. This makes money a human-made construct, not a natural truth.

Chasing account balances, we equate them with success, yet those numbers rely on a shaky economic system. Without trust, they’re meaningless digits. This paradox—valuing something inherently valueless—defines the belief-driven value of money, fueling both opportunity and instability in our lives.

The Impact of Money’s Illusion on Society

Shaping social behavior, the illusion of money creates hierarchies and drives ambition. It decides who gets better schools or healthcare, deepening inequality. For instance, a larger bank balance often means more opportunities, spurring competition. This belief in money’s power pushes people to work harder but also breeds stress and division. The myth of money’s worth shapes how we live and dream.

Societies run on this shared belief, with governments issuing money to fund projects. When trust falters, as in economic crashes, panic spreads, exposing money’s fragility. Meanwhile, ads and culture tie money to happiness, urging us to chase a myth. This cycle influences everything from career choices to personal values, showing money’s grip on social behavior.

Globally, the faith-based value system affects trade and power. Nations rely on stable currencies, giving some countries more influence. Yet, this clout rests on belief, not substance, sparking tensions when faith wanes. By driving personal goals and international deals, the monetary myth reveals its deep hold on humanity.

Challenges of the Monetary System

The monetary myth carries risks that expose its flaws. Inflation can erode money’s value, turning savings to dust over time. In extreme cases, like hyperinflations, people needed bags of cash for bread. This instability shows how the economic system, built on trust, can falter. A belief-driven system is only as strong as the faith behind it.

Inequality is a stark issue. Wealth concentrates in few hands, leaving others behind, fueling unrest. The illusion of money worsens this, as wealth becomes a measure of worth, not just a tool. Moreover, those with more gain power, tilting the system in their favor. This creates a cycle where the myth deepens social divides, challenging fairness.

Sustaining collective trust is tough. Bank failures or crashes can shatter faith, making money worthless overnight. For example, digital currencies face doubts about stability, adding new risks. These issues—instability, inequality, and fragile trust—highlight the limits of a system rooted in a shared belief, pushing us to rethink its foundation.

Money and the Future

Looking ahead, the myth of money’s worth faces new tests. Cryptocurrencies like Bitcoin offer decentralized options, but their value still depends on collective trust. For instance, Bitcoin’s price swings show belief, not substance, drives it. The illusion of money persists in these new forms, as trust remains the core. The future hinges on whether we embrace these systems.

Technology makes money feel more abstract. Cashless payments and apps turn it into screen numbers, raising privacy and security concerns. However, these systems need trust to work, just like cash. Meanwhile, the economic system must evolve to keep faith intact. The belief-driven value adapts, but its reliance on trust stays constant.

Could we escape this myth? Some envision a world without money, sharing resources by need. Yet, replacing money demands a new trust system, hard to scale globally. The monetary myth may endure because it simplifies trade, despite its risks. Its future will balance innovation with the faith that keeps it alive.

Leave a Reply